A Turning Point in Global Oil Pricing

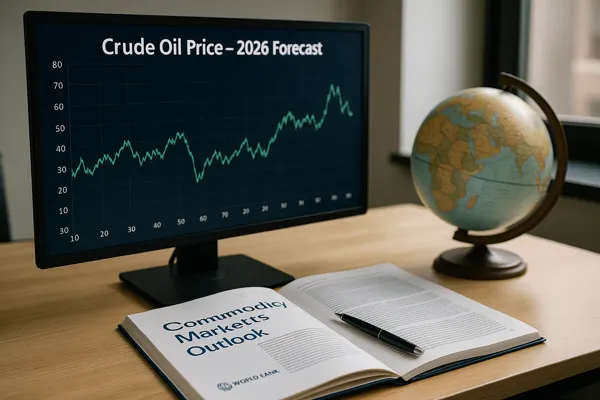

The Crude Oil Price 2026 forecast by the World Bank marks a defining moment for the global energy economy. In its Commodity Markets Outlook released in October 2025, the Bank projects Brent crude will average around $60 per barrel in 2026, down from $68 in 2025. This signals a new phase of market cooling driven by slower economic recovery, declining industrial demand, and increased supply from emerging producers.

Market History and Trends – From Volatility to Stability

The oil market’s last half-decade has swung from collapse to crisis and now, normalization. COVID-19 crashed prices below zero in 2020; Russia’s 2022 invasion then pushed them above $120. Today, stabilization dominates.

The World Bank’s data underpinning its Crude Oil Price 2026 projection suggests a more predictable market sustained by diversified supply chains, strategic stock releases, and the accelerating clean-energy transition.

Underlying Drivers of the 2026 Forecast

• Slowing Demand Across Key Economies

Global consumption is flattening. China’s industrial slowdown and efficiency mandates in the EU are curbing import volumes, keeping demand growth below 1 % a year through 2026.

• Rising Output Outside OPEC Control

New fields in the United States, Brazil, and Guyana are injecting millions of additional barrels daily. This oversupply reinforces the Bank’s $60 estimate for Crude Oil Price 2026.

• Moderated OPEC+ Strategy

OPEC and its partners are expected to ease coordinated cuts to protect market share, further limiting price recovery.

• Policy Shift to Renewables

Net-zero commitments and rapid EV adoption are trimming oil’s share of global energy demand, steering prices toward structural moderation.

• Reduced Geopolitical Tension

Diminished conflict-related risks have calmed speculation that once spiked crude benchmarks.

Economic Analysis – Winners, Losers and Market Adjustments

The Crude Oil Price 2026 scenario distributes gains unevenly.

- Importers like India and Japan benefit from lower transport and manufacturing costs, helping ease inflation.

- Exporters such as Saudi Arabia, Nigeria, and Ghana face revenue pressures that could tighten budgets.

- Investors may rotate away from traditional oil stocks toward renewables and green technology, reshaping capital flows over the next decade.

Expert Insights and Institutional Perspectives

“Commodity markets are normalizing as supply expands and demand growth weakens. Brent crude is projected to average $60 per barrel in 2026.” — World Bank Press Release, Oct 2025

Energy analyst Fatih Birol of the IEA notes that the world is approaching its demand plateau, while Goldman Sachs and J.P. Morgan foresee a trading range between $58 and $65 as structural equilibrium takes hold.

Such consensus reinforces the Crude Oil Price 2026 outlook as the new benchmark for medium-term planning.

Regional Focus – How Ghana Stands to Gain and Lose

Ghana’s economy, where oil accounts for roughly 4–5 % of GDP, faces both fiscal risks and consumer benefits.

Fiscal Impact: Budget assumptions above $70 per barrel may need revision if the Crude Oil Price 2026 average holds at $60, potentially cutting revenue from Jubilee and TEN fields.

Consumer Relief: Lower import costs could ease fuel and transport prices, helping contain inflation.

Currency Stability: A steady oil market supports cedi stability and reduces exchange-rate volatility.

Economist Dr. Patrick Asiedu told GSN, “A $60 oil world may shrink government revenue but brings macro stability that benefits households and businesses.”

Strategic Outlook – Energy Transition and Future Policy

The Crude Oil Price 2026 narrative underscores the dawn of a low-carbon future. Governments and corporations are reallocating capital toward renewables, hydrogen, and carbon-neutral technologies.

Countries diversifying early—like Saudi Arabia’s Vision 2030 or Ghana’s renewable projects—will be best positioned to thrive when fossil revenues fade.

Balancing Revenue and Resilience

At an expected Crude Oil Price 2026 of $60 per barrel, the world enters an era of measured stability rather than boom or bust. For exporters like Ghana, the task ahead is clear: diversify economies, optimize spending, and leverage cheaper energy to accelerate industrial growth.

For consumers and importers, it signals relief and predictability. The oil market may be cooling, but the global energy transition is just heating up.

Internal Links

- Ghana Pay Rise: 9% Wage Increase Confirmed for 2026

- AI Chatbots Under Fire After Teen Suicide Allegations

External Links

- World Bank Commodity Markets Outlook – October 2025

- International Energy Agency – Oil Market Report 2025