Introduction: Ghana’s Forex Fee Sparks Nationwide Debate

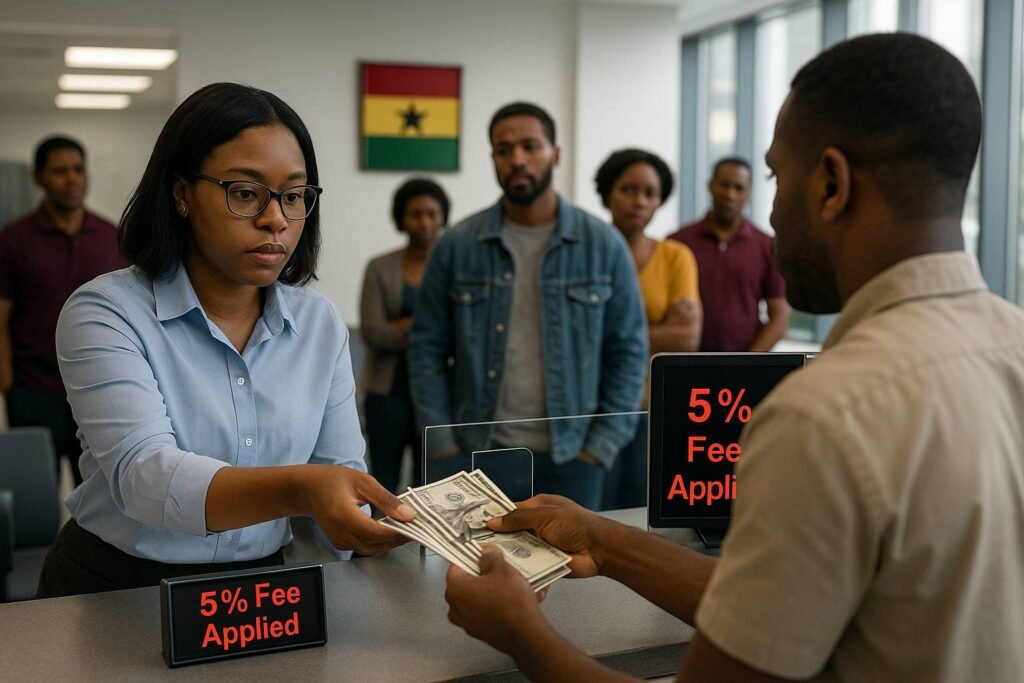

Accra, Ghana — Commercial banks have begun enforcing banks 5 % forex withdrawals, a controversial fee dividing economists, traders, and the public. Lenders claim compliance with new Bank of Ghana (BoG) guidelines, yet no official circular explicitly confirms such a directive.

This ambiguity has fueled unease, with many Ghanaians asking whether banks 5 % forex withdrawals are meant to stabilize the cedi or simply add a burden on customers without legal basis.

Background: Forex Market Tensions and BoG Oversight

Ghana’s foreign-exchange market has been under pressure since 2024, weighed down by import dependency, shrinking reserves, and cedi volatility. To restore stability, the Bank of Ghana tightened rules for Money Transfer Operators (MTOs) and Payment Service Providers (PSPs).

BoG also issued a circular on the Abolition of Unfair Fees and Charges, stressing that banks must avoid costs that impede financial inclusion. Yet several institutions now cite these regulations to justify banks 5 % forex withdrawals, creating what critics call a policy contradiction.

The result is a national debate over whether these charges represent policy innovation or regulatory overreach.

Current Development: What We Know So Far

Reports from major commercial banks confirm that a 5 % deduction already applies to certain foreign-currency cash withdrawals. Officials argue this aligns with BoG’s prudential guidelines discouraging bulk forex movements.

However, BoG has not released any directive mandating banks 5 % forex withdrawals. This gap in official communication has sparked confusion among analysts and customers alike.

“The core issue is transparency,” an economist told Global Standard News (GSN). “If BoG hasn’t formally approved it, then banks are acting beyond their mandate.”

Analysis: Why Banks Are Introducing the 5 % Fee

Possible drivers behind the move include:

- Preserving Reserves – Discourages bulk dollar withdrawals to protect foreign assets.

- Cedi Stabilization – Curbing speculative demand for foreign cash.

- Digital Shift – Encouraging electronic payments over physical withdrawals.

- Revenue Diversification – Generating income under tight margin pressures.

Supporters say banks 5 % forex withdrawals can aid macroeconomic discipline; critics warn they violate BoG’s consumer-protection framework. Recent data from JoyNews Business show Ghana’s reserves fell by 7 % in early 2025, a factor likely prompting these unilateral actions.

Public Reaction: Outrage and Social Media Backlash

Public response has been swift and divided:

- Small Businesses say the fee raises import costs and erodes profits.

- Parents and Students Abroad fear higher remittance expenses.

- Social Media Users amplify hashtags like #ForexFee and #Stop5PercentCharge, urging BoG to intervene.

One viral comment read: “We save in foreign currency for security, not punishment.” Advocates argue that banks 5 % forex withdrawals contradict BoG’s own fair-banking principles unless legally authorized.

Regional and Global Context

Across Africa, governments use forex controls to shield currencies: Nigeria limits dollar withdrawals, Kenya demands transaction documentation, and South Africa caps purchases.

Ghana’s case stands out for its policy ambiguity — a fee applied without explicit regulatory backing. Experts warn that continuing banks 5 % forex withdrawals unchecked could drive transactions to the black market and undermine BoG’s credibility.

Economic Implications: What’s at Stake

If uncorrected, the policy may trigger four major risks:

- Parallel Market Growth — pushing activity outside banks.

- Liquidity Tightening — reducing cash flow within the system.

- Public Distrust — damaging confidence in monetary oversight.

- Inflationary Spill-over — importers passing fees to consumers.

Analysts say clarity on banks 5 % forex withdrawals is essential to avoid slowing Ghana’s IMF-backed recovery.

Where the Bank of Ghana Stands

As of October 2025, no BoG publication formally authorizes a 5 % withdrawal fee. Official statements instead emphasize cashless transactions and compliance oversight.

Insiders suggest banks may be “over-interpreting” existing rules, but BoG’s silence sustains market uncertainty.

“Either BoG confirms the policy or stops it,” a banking consultant told GSN. “Silence is fueling distrust.”

Reactions from Experts and Industry Voices

- The Institute of Economic Affairs (IEA) urged BoG to clarify its stance “to prevent market distortion.”

- The Ghana Union of Traders Association (GUTA) warned that hidden charges could “cripple import trade.”

- Independent economists called for a temporary suspension of banks 5 % forex withdrawals until official confirmation is issued.

Parliament’s Finance Committee faces mounting pressure to summon both BoG and the Ghana Association of Bankers for answers.

Local and Global Impact

Domestically, the fee risks undermining trust in financial institutions and raising costs for import-dependent firms. Globally, Ghana’s situation is seen as a test of how emerging economies balance currency defense with consumer rights.

Investors watching Ghana’s IMF programme say regulatory ambiguity could dampen confidence and delay capital inflows.

Conclusion: Clarity Needed to Restore Confidence

Until the Bank of Ghana clarifies its position, the controversy over banks 5 % forex withdrawals will linger. The policy’s uncertain status threatens both public trust and macroeconomic stability.

Transparent communication and firm policy guidance are crucial to rebuild confidence in Ghana’s financial system.

Burkina Faso Visa-Free Access Shocks Africa

Audit Uncovers Babies on NSA Payroll in Shocking Scandal

World Bank $360M Ghana Disbursement to Stabilize Economy

- Bank of Ghana – Abolition of Unfair Fees, Charges and Other Practices

- Citi Newsroom – Banks effect 5% fee on forex withdrawals

- Ghanaian Times – BoG directs banks to halt forex payments to corporates