A Turning Point in Global Tech Manufacturing

The Apple Global Investment Shift represents one of the most ambitious industrial realignments in modern history. On August 6, 2025, Apple announced a $100 billion U.S. manufacturing investment and a $1.5 billion India expansionthrough its partner Foxconn — a move set to redefine global technology production and innovation.

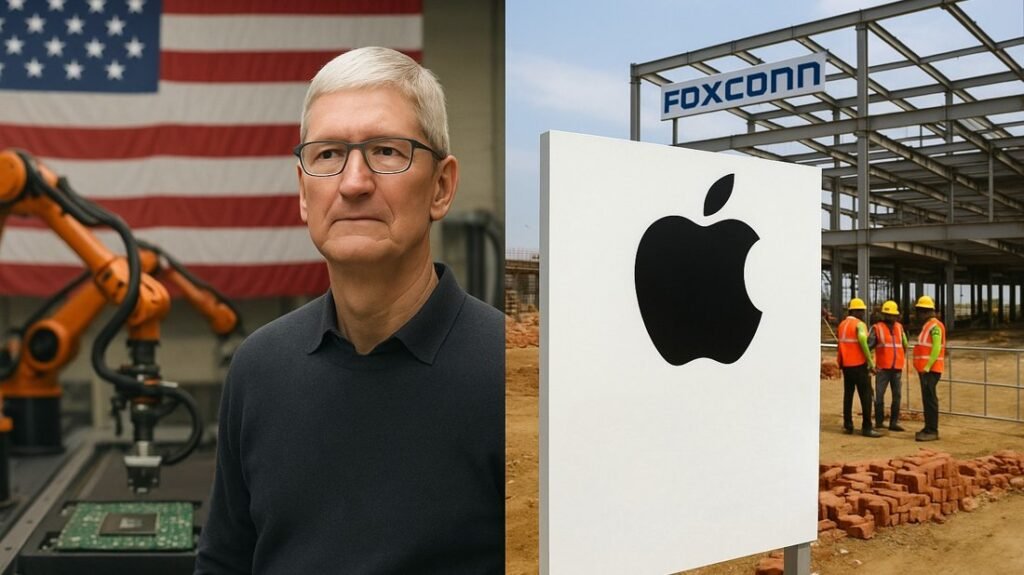

“We believe innovation and resilience begin at home,” said Tim Cook, Apple’s CEO. “This investment strengthens our supply chain, creates jobs, and reflects our long-term commitment to the global economy.”

From Chinese Dependence to Global Diversification

For decades, Apple’s manufacturing story was inseparable from China. Its Shenzhen and Zhengzhou facilities once produced over 90% of iPhones. However, pandemic lockdowns, geopolitical frictions, and tariff escalations forced a rethink.

Today’s Apple Global Investment Shift reflects a calculated pivot toward resilience—spreading production across the U.S., India, and emerging Southeast Asian hubs. Apple aims to reduce single-region risks while strengthening political ties with Washington and New Delhi.

$100 Billion U.S. Investment: Rebuilding America’s Tech Backbone

The U.S. component of the Apple Global Investment Shift was unveiled at a manufacturing summit in Austin, Texas, alongside former President Donald Trump. The initiative raises Apple’s total domestic investment to $600 billion under the American Manufacturing Program over the next four years.

📍 Key Focus Areas

- AI and silicon chip design

- Optical glass and display components (via Corning and Coherent)

- Rare-earth magnet production (via MP Materials)

- Advanced fabrication partnerships with TSMC, Broadcom, and GlobalFoundries

According to AP News, Trump described the plan as a “renaissance of American manufacturing,” while Business Insiderconfirmed Apple’s eligibility for tariff exemptions under the new 100% chip import tax policy.

The investment is expected to:

- Support 450,000 jobs nationwide

- Create 20,000 new high-paying roles in R&D and chip engineering

- Strengthen AI chip sovereignty within U.S. borders

Apple’s expansion will include R&D labs in California, silicon design hubs in Arizona, and manufacturing facilities in Texas, further reinforcing the Apple Global Investment Shift toward domestic innovation.

$1.5 Billion India Expansion via Foxconn

In parallel, Foxconn, Apple’s key supplier, announced a $1.5 billion display module plant in Oragadam, Tamil Nadu, operated by Yuzhan Technology India.

This plant will:

- Assemble iPhone display modules for global export

- Employ 14,000 workers directly

- Strengthen India’s role in Apple’s growing value chain

According to Reuters, the project bolsters India’s reputation as a China-plus-one manufacturing hub and complements the “Make in India” initiative under Prime Minister Narendra Modi, which offers tax holidays and infrastructure support to advanced tech firms.

The India move underscores the Apple Global Investment Shift toward strategic regional diversification and deeper economic collaboration with Asia’s fastest-growing economy.

Why the Apple Global Investment Shift Matters

1. China Dependency Is Eroding

Apple is methodically diversifying away from China’s manufacturing stronghold.

- India’s share of iPhone production rose from 6% in 2021 to 18% in 2024.

- The company targets 60 million U.S.-bound iPhones from India by 2026.

- Foxconn and Pegatron continue rapid expansion.

This trend reflects a wider global pattern of friend-shoring and de-risking amid growing geopolitical uncertainty.

2. AI Chips and Technological Autonomy

Beyond production, Apple’s focus lies in AI and silicon independence.

The company’s M5 and A18 chipsets will be produced domestically using TSMC Arizona facilities and Apple’s proprietary labs—powering AI-integrated iPhones, MacBooks, and Vision Pro devices.

IDC analyst Chris Wu commented:

“This is how Apple ensures control over the next decade of AI computing.”

3. India: Apple’s Emerging Powerhouse

The India leg of the Apple Global Investment Shift is transformative.

By 2026, India could produce half of Apple’s mobile exports, leveraging Foxconn, Wistron, and Pegatron facilities.

India exported $10 billion in smartphones in FY2024, led by Apple’s surge in production.

The Tamil Nadu government continues to attract global tech investors through new tech parks, training programs, and tax incentives tailored for advanced electronics manufacturing.

Reactions and Political Context

The Apple Global Investment Shift has been praised across both continents.

In the United States, policymakers view the initiative as a national security win, enhancing AI self-sufficiency and job creation.

In India, leaders describe it as a “transformational partnership,” symbolizing growing strategic trust and mutual economic leverage.

Former Indian Chief Economic Advisor Arvind Subramanian told The Hindu Business Line:

“The Apple–India relationship has evolved into a strategic partnership—not just a commercial one.”

Global and Economic Implications

The Apple Global Investment Shift carries sweeping implications for global economics and geopolitics:

- For the U.S.: Boosts domestic innovation, AI capacity, and manufacturing employment.

- For India: Elevates industrial prestige, exports, and geopolitical standing.

- For China: Signals a steady erosion of dominance over global tech production chains.

According to the Financial Times, Apple’s approach reflects a broader multinational strategy of relocalizing supply chains toward politically stable markets.

Quick Comparison Table

| Region | Investment | Primary Focus | Jobs Created |

|---|---|---|---|

| United States | $100 billion | AI chips, advanced components | 20,000 direct; 450,000 supported |

| India | $1.5 billion | iPhone display modules (Foxconn) | 14,000 direct |

A Defining Moment for Global Industry

The Apple Global Investment Shift is not merely a financial maneuver—it represents a strategic evolution in how technology giants navigate risk, resilience, and regional influence.

By reinforcing production bases in the U.S. and India, Apple has positioned itself at the heart of a two-pillar system balancing innovation, security, and sovereignty.

As the world transitions toward AI-driven economies, Apple’s blueprint could serve as a model for sustainable and politically aligned manufacturing.

Internal Links:

- New AI Community Center Opens in Accra as Google Unveils $37M in Africa AI Commitments

- Meta Invests Billions in AI Data Centers Prometheus and Hyperion

External Links: